Major Shareholders

Last Update Date: March 31,2025

| Name of Shareholder | Number of Shares Held (Thousand shares) |

Holding Ratio (%) |

|---|---|---|

| The Master Trust Bank of Japan, Ltd. (Trust Account) | 355,028 | 18.1 |

| Custody Bank of Japan, Ltd. (Trust Account) | 139,805 | 7.1 |

| Nippon Life Insurance Company | 76,765 | 3.9 |

| JP MORGAN CHASE BANK 385632 | 70,600 | 3.6 |

| The Hachijuni Bank, Ltd. | 57,136 | 2.9 |

| Meiji Yasuda Life Insurance Company | 53,439 | 2.7 |

| STATE STREET BANK AND TRUST COMPANY 505001 | 48,068 | 2.5 |

| GOVERNMENT OF NORWAY | 36,306 | 1.9 |

| STATE STREET BANK WEST CLIENT – TREATY 505234 | 35,828 | 1.8 |

| JP MORGAN CHASE BANK 385781 | 27,851 | 1.4 |

The holding ratios are computed net of this treasury stock.

Shareholders’ Returns

Basic Policy Concerning Profit-sharing

From a long-term perspective, we are focusing on expanding profitability and maintaining a solid financial base, with the basic policy of returning the fruits of such management efforts to our shareholders in a proper and stable manner. We strive to increase our corporate value by the aggressive and timely use of internal reserves for enhanced global competitiveness, further business development and further growth. Further, we will maintain our solid financial base to enable us to face the increasing frequency and amplitude of economic fluctuations that may occur. Based on this policy, we approach our capital policy with careful attention to the Return on Equity and the Cost of Capital. Shareholder returns are at the core of this. While considering various circumstances, we have aimed for stable dividends at a dividend payout ratio of around 35% in the mediumto long-term. The dividend payout ratio for the past 10 years was 31%. We will continue to take various factors into consideration as we work to raise our dividend payout ratio to 40% over the medium to long term. Also, we will determine the need for purchase of treasury stocks.

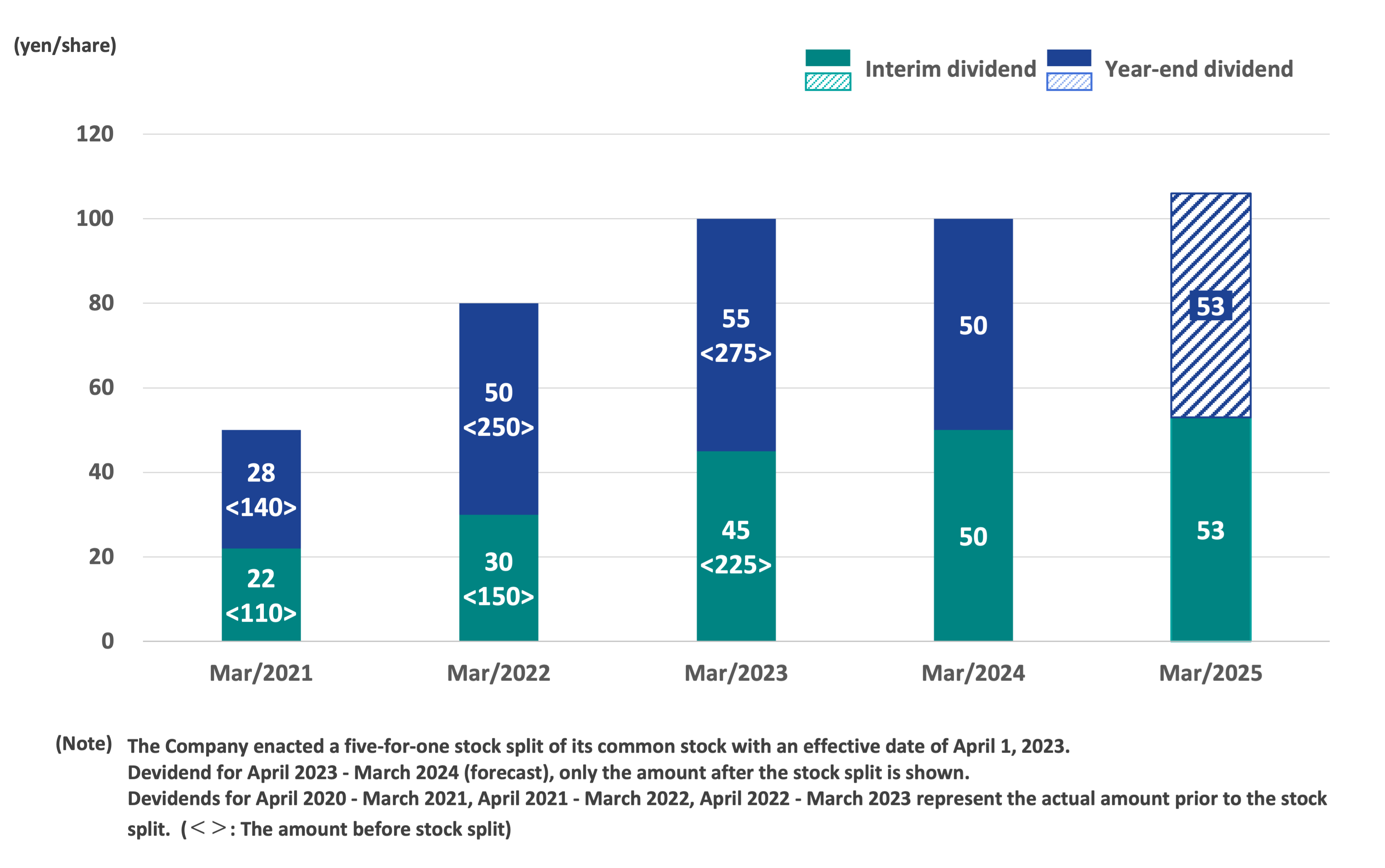

Trend of Dividend per Share

(yen/share)

| Mar/2021 | Mar/2022 | Mar/2023 | Mar/2024 | Mar/2025 | |

|---|---|---|---|---|---|

|

Interim dividend (Before stock split) |

22 (110) |

30 (150) |

45 (225) |

50 |

53 |

|

Year-end dividend (Before stock split) |

28 (140) |

50 (250) |

55 (275) |

50 |

53 (Forecast) |

|

Annual dividend (Before stock split) |

50 (250) |

80 (400) |

100 (500) |

100 |

106 (Forecast) |

Repurchase of treasury stock in the past five years

| Purchase period | Number of shares purchased | Total share purchase amount (billion yen) | Purchase method |

|---|---|---|---|

| April 28, 2022 to June 20, 2022 | 5,717,200 shares | 999.99 | Market purchases on the Tokyo Stock Exchange |

| July 28, 2022 to December 21, 2022 | 6,121,000 shares | 999.98 | Market purchases on the Tokyo Stock Exchange |

| July 28, 2023 to October 24, 2023 | 22,431,200 shares | 999.99 | Market purchases on the Tokyo Stock Exchange |

| May 20, 2024 to September 11, 2024 | 16,695,900 shares | 999.99 | Market purchases on the Tokyo Stock Exchange |

| December 18, 2024 to January 22, 2025 | 20,060,070 shares | 939.81 | By tender offer |

*Excluding acquisition of treasury stock for the purpose of Issuance of Stock Acquisition Rights in the form of Stock Options .

Ratings

Last Update Date: February 3, 2025

| Rating Agency | Long-term Ratings | |

|---|---|---|

| Moody’s | Aa3 | |

| R&I | AA+ | |

| JCR | AAAp | |

Analysts’ Coverage

Companies with analysts covering Shin-Etsu are :

| Company | Analyst |

|---|---|

| BofA Securities Japan Co., Ltd. | Takashi Enomoto |

| Citigroup Global Markets Japan Inc. | Yuta Nishiyama |

| CLSA Securities Japan Co., Ltd. | Yifan Zhang |

| Daiwa Securities Co. Ltd. | Hidemitsu Umebayashi |

| Goldman Sachs Japan Co., Ltd. | Atsushi Ikeda |

| JPMorgan Securities Japan Co., Ltd. | Yasuhiro Nakada |

| Macquarie Capital Securities (Japan) Limited | Damian Thong |

| Mizuho Securities Co., Ltd. | Mikiya Yamada |

| Morgan Stanley MUFG Securities Co., Ltd. | Takato Watabe |

| Nomura Securities Co., Ltd. | Shigeki Okazaki |

| Okasan Securities Co., Ltd. | Takashi Nishihira |

| SBI Securities Co., Ltd. | Masami Sawato |

| SMBC Nikko Securities Inc. | Go Miyamoto |

| Tokai Tokyo Intelligence Laboratory Co., Ltd. | Shuichi Nakahara |

| UBS Securities Japan Co., Ltd. | Shunta Omura |